Every Cyprus tax resident company must declare, at least, the 70% of its accounting profits for the year 2020 by 31 December 2022 and pay the special contribution for defence of 17% and National Health Contribution of 2,65% by 31 January 2023.

Deemed Dividend Distribution (DDD) provisions

According to the DDD provisions, a Cyprus tax resident company should distribute at least 70% of its accounting profits to its Cyprus tax resident shareholders, as dividends, within two years from the end of the tax year to which such profits relate. If the aforesaid profits (or part of them) were not distributed, then the relevant undistributed accounting profits would be considered as "deemed distributed" and the relevant Special Defence Contribution would need to be paid.

DDD provisions are applicable in cases that a Cyprus tax resident company has shareholders that are Cyprus tax residents and Cyprus domiciled and the Cyprus tax resident company has not distributed at least the 70% of its accounting profits for a specific tax year.

The DDD provisions also apply for National Health Contribution purposes in cases that a Cyprus tax resident company has ultimate shareholders Cyprus tax resident individuals (domicility is irrelevant).

Therefore, in the case that a Cyprus tax resident company has failed to distribute at least the 70% of its accounting profits for the year 2020 by 31 December 2022, then the DDD provisions of the Special Contribution for the Defence Law will come into force.

The deemed dividend distribution provisions on the accounting profits for the tax year 2020 will be triggered on 31 December 2022. The said provisions will come into force in case a Cyprus tax resident company does not distribute at least 70% of its 2020 accounting profits by 31 December 2022.

The National Health Contribution should also be paid by 31 January 2023 for the undistributed accounting profits.

Whereas a Cyprus tax resident company is ultimately owned by a non-Cyprus tax resident individual, the DDD provisions are not applicable.

The relevant form to be submitted by the end of the following month of the dividend declaration (actual or deemed) to the Tax Authorities is T.D. 603.

In the case of late payment of the special contribution for defence and national health contributions then there will be an imposition of interest at the rate of 1,75% per annum and to a 5% penalty of the tax due. It should also be noted that an additional 5% penalty may be imposed in the case that the special contribution for defence remains unsettled two months after the above due dates. Also, there is a penalty of €100 if the T.D. 603 form is not submitted within the deadlines.

We remain at your disposal for anything you may need.

Contact person

Stelios Ioannou

This email address is being protected from spambots. You need JavaScript enabled to view it.

+357 22 100 192

Managing Director

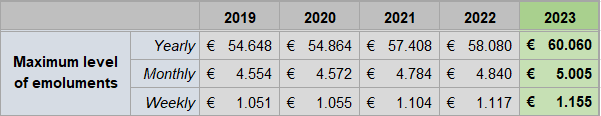

The Social Insurance Contributions rate of 8,3% is applied to a maximum level of emoluments.

For 2023, the yearly maximum level of emoluments is €60.060.

The rate of 8,3% applies for both the employer and the employee as from 1 January 2019 and for the next five years. Thereafter, the rate will increase every five years by 0,5% until it reaches 10,3% as from 1 January 2039.

The following table summarises the changes in the maximum level of emoluments, over the years 2019 - 2023:

We remain at your disposal for anything you may need in connection with the above.

Contact person

Stelios Ioannou

This email address is being protected from spambots. You need JavaScript enabled to view it.

+357 22 100 192

Managing Director

On 11 November 2022, an amendment to the 8th Schedule of the VAT Law was introduced with the decree 423/2022, replacing the phrase "before the first occupation" with the following:

"before the first supply within a period of five (5) years from the date of completion and any subsequent supplies within the period of five (5) years provided that no actual use by unrelated person has been occurred for at least of a period of twenty four (24) months”.

Therefore, effective from 11 November 2022, new criteria apply to determine whether the supply of a building and the land transferred therewith is considered as a taxable or an exempt supply in regards to VAT.

We remain at your disposal for anything you may need in connection with the above.

Contact person

Stelios Ioannou

This email address is being protected from spambots. You need JavaScript enabled to view it.

+357 22 100 192

Managing Director

On 28 November 2022, the Department of Registrar of Companies and Intellectual Property announced that, following the Judgement of the Court of Justice of the European Union (CJEE) in joined cases C-37/20 and C-601/20, of November 22, 2022, access to the Register of Beneficial Owners for the general public is suspended as of the 23rd of November 2022.

According to the above-mentioned Judgement of the CJEE, Article 1, point 15(c) of Directive (EU) 2018/843 of the European Parliament and the Council, of 30th May 2018, which provides for access to the information on the beneficial ownership of legal entities to any member of the general public, is invalid as it constitutes a serious interference with the fundamental rights of respect for private life and to the protection of personal data, enshrined in Articles 7 and 8 respectively, of the Charter of Fundamental Rights of the European Union.

The relevant information to the competent and supervisory authorities and the Unit as referred in article 12 of Directive R.A.A. 112/2021 and amending Directive R.A.A. 116/2022, will continue to be provided with the applicable procedure.

The relevant information will, also continue to be provided to the obliged entities, with the applicable procedure by submitting additionally a solemn declaration confirming that the information on the Beneficial Owners is requested within the context of performing customer due diligence.

We remain at your disposal for anything you may need in connection with the above.

Contact person

Stelios Ioannou

This email address is being protected from spambots. You need JavaScript enabled to view it.

+357 22 100 192

Managing Director

According to a law published in the official Government Gazette on 22 February 2021, a levy of 0,4% tax, payable by the seller, is applicable on all sales of properties located in Cyprus and/or disposals of shares of companies owning (directly or indirectly) properties located in Cyprus.

The law is aiming to compensate the Greek-Cypriot refugees for their inability to possess, have access to, or otherwise gainfully use their land due to the Turkish invasion and occupation of the northern third of the island in 1974.

An amendment of the law, published in early December 2022, specifies the Tax Commissioner as the responsible authority to collect the 0,4% levy on property sales.

We remain at your disposal for anything you may need in connection with the above.

Contact person

Stelios Ioannou

This email address is being protected from spambots. You need JavaScript enabled to view it.

+357 22 100 192

Managing Director