We would like to remind you for the requirements of the Cyprus Tax Legislation (Assessment and Collection Law as amended in 2002, article 24) regarding the filing of temporary tax returns and relevant temporary tax payments for the year 2022.

Please note that a Temporary Tax Assessment of the estimated net taxable profit for the year 2022 (if any), should be submitted to the Tax Authorities by 31st of July 2022. The resulting tax is payable in two equal installments as per the following deadlines:

- 1st instalment: 31st of July 2022

- 2nd instalment: 31st of December 2022

Any final resulting tax liability for the year 2022 should be settled by 1st of August 2023.

Your estimation of the taxable profit (if any) must be as close as possible to the actual net taxable profit of the company and any taxes underestimated may be liable to a 10% surcharge. If you require assistance in calculating your estimated taxable profit, then please provide us with an estimated income statement (detailed) for the year and we will provide you with a forecast income tax computation together with our advice as to whether you should proceed with the filing of a Temporary Tax return or not. It is important to note that companies with no taxable profits do not need to deal with the submission of this return.

Revision of the Temporary Assessment form

Following the submission of the provisional income tax return you may submit a revised declaration (upwards or downwards), at any time before 31 December 2022. However, submitting a revised provisional tax declaration with a decreased estimated taxable profit may not result in an immediate refund of the provisional tax already paid until the final tax computations are filed and agreed with the Cyprus tax authorities.

Interest and Penalties

- An administrative penalty of 5% is imposed on each instalment if the company fails to pay the declared tax by the due dates stated above.

- Interest on an overdue instalment of the tax is calculated at an annual interest rate of 1,75%, on the basis of completed months.

- If the provisional tax declared is lower than the 75% of the actual tax payable for the year, then an additional 10% tax is imposed on the difference of the two.

As the temporary tax relies on the management’s best estimate, it is our recommendation that this should be dealt with only by companies which have their accounting records up to date and are in a position to accurately estimate what the expected taxable profits will be at the end of the year.

For any further information, or if you would like us to proceed with assisting you with the above, please do not hesitate to contact us.

You could proceed with the payment of the provisional tax through JCC. Alternatively, we can take over of the above responsibility. The estimation of profits and transfer of funds in our client’s bank account should reach our office by the 20th of July 2022, otherwise we will consider it as an assumption by you of the responsibility to comply with this obligation.

Please bear in mind that our fees for the above will be €50 plus VAT (total €59,50).

Our client’s bank account details can be found below:

CosmoCo Ltd (Clients A/C)

Bank of Cyprus Public Ltd

Account Number: 357003572612

IBAN: CY18002001950000357003572612

Swift Code: BCYPCY2N

On the transfer details please indicate your Company name and "Temporary Tax 2022".

We remain at your disposal for anything you may need in connection with the above.

Contact person

Stelios Ioannou

This email address is being protected from spambots. You need JavaScript enabled to view it.

+357 22 100 192

Managing Director

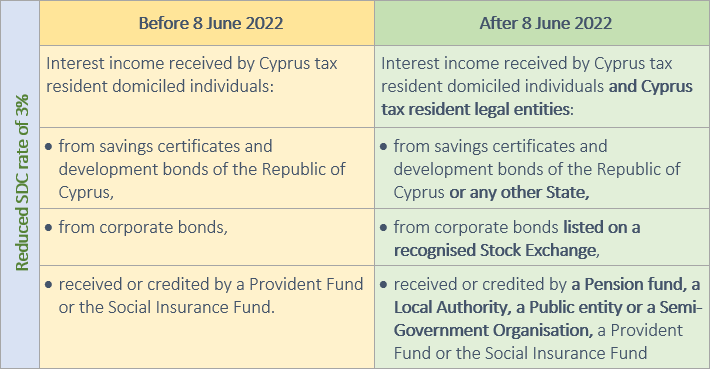

The Cyprus Parliament has passed an amendment of the Special Defence Contribution (SDC) Law (117(I)/2002), which is effective as from the 8th of June 2022.

What you need to know

The amendment aims to broaden the application of the reduced SDC rate of 3%. The following table indicates the changes:

Furthermore, the amendment now clarifies that interest income derived from the ordinary carrying on of a business or closely connected with the ordinary carrying on of a business is not considered as interest and therefore it does not fall within the provisions of the SDC law.

We remain at your disposal for anything you may need.

Contact person

Stelios Ioannou

This email address is being protected from spambots. You need JavaScript enabled to view it.

+357 22 100 192

Managing Director

We would like to remind you that all companies incorporated in Cyprus, irrespective of whether they are active or not, or have assets or not, are subject to a €350 levy per annum.

The last day of payment of the annual levy for the year 2022 is the 30th of June 2022. For a late payment of the 2022 Annual Levy, a penalty will be imposed from the Registrar of Companies.

You can proceed with the payment of the annual levy online, through JCCsmart.

Otherwise, we can take over the payment of the Annual Levy on your behalf. The procedure that you need to follow is the following:

1. Transfer the amount of €380 (€350 for the levy payment + €30 to cover our fees and bank charges) to our Clients' Account found below, by 10/06/2022:

CosmoCo Ltd (Clients A/C)

Bank of Cyprus Public Ltd

Account Number: 357003572612

IBAN: CY18002001950000357003572612

SwiftCode: BCYPCY2N

2. On the bank transaction details, indicate "Annual Levy" and your Company Name.

3. Send us a confirmation e-mail at This email address is being protected from spambots. You need JavaScript enabled to view it. requesting the annual levy payment along with an attachment of the bank transfer confirmation, by 10/06/2022.

If you have already paid the 2022 Annual Levy, please ignore this announcement.

Please be informed that the last day for the submission of the 2021 employer's TD7 return is the 31st of May 2022.

For any further information, please do not hesitate to contact us.

Contact person

Stelios Ioannou

This email address is being protected from spambots. You need JavaScript enabled to view it.

+357 22 100 192

Managing Director